Among the abbreviations in the world of accounting & taxation, LLCs and S-Corps often get bunched together.

They are similar, yet different.

But before your head starts spinning, don’t worry. We’ve broken it all down for you with this blog.

Let’s untangle an LLC from an S-Corporation, and see what each one means for your business and taxation.

What is an LLC?

An LLC is a U.S. legal entity that you set up to own and operate a business. It is one of the most common business structures, alongside sole proprietorships, partnerships, and corporations.

We can look at an LLC as a mix between a sole proprietorship and a corporation, which makes the entity an attractive one, seeing as you get the assurance of limited liability protection but without added regulatory complexity.

Like a corporation, there is a legal separation between an LLC owner’s personal assets and the business’s debts and lawsuits.

You can sleep soundly at night knowing that business creditors cannot bring a wrecking ball to your family home if they are able to do the same to your office.

State laws treat LLCs the same way they treat sole proprietorships and partnerships when it comes to administrative requirements and taxation.

They enjoy a high level of flexibility in administrative matters, such as board of directors requirements, shareholder meeting requirements, and so on, and often fall under the same IRS tax category as sole proprietorships and partnerships.

What is an S-Corp?

And this leads us to an S-Corp, which some may mistake as a business entity, like an LLC.

But rather than an apple-to-apple comparison, think of an S-Corp as a close cousin, like a pear. Except juicier due to the potential tax savings.

So how are they different?

For one, an LLC is a business entity. An S-Corp is not.

An S-Corp is simply a tax election you can make for your business alongside your LLC or other designated business entity.

LLC vs. S Corp: How Are They Related?

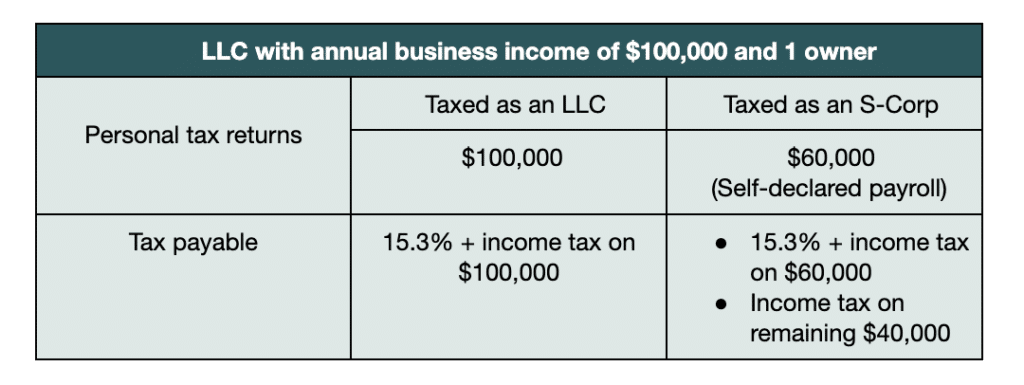

Ordinarily, an LLC has the same tax treatment as sole proprietorships and partnerships, where business owners report all business income and expenses on their personal tax returns.

In addition to income tax, the business owners are also subject to a self-employment FICA tax rate of 15.3% for Social Security and Medicare.

However, you can elect a different tax treatment from the default while still running your business as an LLC, and that’s where an S-Corp comes in.

It is a tax treatment that allows you to draw and report personal income from your business as an employee, rather than a self-employed owner.

You get to determine the amount of payroll to declare, and only pay FICA Social Security and Medicare taxes for that portion. The rest of the business income is not subject to these taxes.

Here’s an illustration:

There is a catch though.

Your self-declared payroll must be reasonable – based on your industry, nature of work, hours put in, location, and other factors – and will be subject to IRS examination.

For example, you cannot pay yourself $20,000 for the same role that you would pay someone else $100,000 to do in order to save on taxes.

When Should You Become an S-Corp?

So, when does it make sense to treat your business to the juicier pear?

First things first, make sure your business qualifies for an S-Corp election, meaning it’s:

- A U.S. business.

- Has a maximum of 100 shareholders or owners.

- Shareholders are individuals or certain trusts and estates, but not corporations, partnerships, and non-residents.

Next, comes the number crunching.

Accounting and tax filing as an S-Corp usually requires more expenses and administrative processes, especially with the need to separate business income and expenses from personal payroll. What’s more, you may even need payroll software.

Which is why it’s crucial that the potential tax savings outweigh the extra costs and hassle by a fair chunk before you consider switching to an S-Corp.

There are no hard and fast rules on an LLC’s minimum income level before the scales start to tip in favor of an S-Corp.

That said, generally, you could consider electing this option once your business revenue exceeds $80,000 -$100,000 a year.

Get the Help of a Small Business Advisor

Hopefully, your head has stopped spinning after reading this. An S-Corp can help save on tax dollars, but there’s still quite a bit to chew on before making the switch.

An experienced small business advisor can make this easier, by figuring out the best tax strategy for your unique business.

Don’t have a small business advisor or accountant that you’re happy with?

You can get in touch with us anytime to see how we can help.

We always love helping business owners like you organize and elevate their businesses.

Until next time!